Navigating the world of business growth can be challenging. For many entrepreneurs and companies, tapping into the resources and expertise offered by family offices and large institutions can be a game-changer. These entities possess financial backing and valuable insights that can propel businesses to new heights.

Family offices manage wealth for high-net-worth families, while large institutions encompass various organizations with significant market influence. Their combined experience in diverse industries presents unique opportunities for collaboration.

Understanding how to effectively partner with these influential players is critical to unlocking your growth potential. In this blog post, we’ll explore the benefits and strategies involved in building strong relationships with family offices and large institutions—all aimed at fostering sustainable business growth.

Benefits of Collaborating with Family Offices and Large Institutions for Business Growth

Collaborating with family offices and large institutions offers numerous advantages for business growth. These entities often have extensive capital reserves, providing a significant financial boost that can accelerate expansion plans.

Their network is another invaluable asset. Family offices frequently possess deep connections across various industries, opening doors to new partnerships and opportunities. This networking potential can lead businesses to untapped markets and clients.

Additionally, these institutions’ expertise must be balanced. Their seasoned professionals bring valuable insights into strategic planning and risk management, enhancing decision-making processes.

Working alongside family offices also fosters innovation. Exposure to diverse perspectives encourages creative solutions that drive competitive advantage.

Moreover, these collaborations often focus on long-term sustainability rather than short-term gains. Such alignment in vision promotes stability, which is crucial for enduring success in today’s dynamic marketplace.

Strategies for Approaching and Building Relationships with Family Offices and Large Institutions

Approaching family offices and large institutions requires a thoughtful strategy. Start by conducting thorough research. Understand their values, investment goals, and previous partnerships. This knowledge will help you tailor your approach.

Networking plays a crucial role in building relationships. Attend industry events where these entities are present. Engage in meaningful conversations to create authentic connections.

Consider leveraging mutual contacts for introductions. A warm introduction can significantly increase trust and open doors that cold outreach cannot.

Be transparent about your intentions and business objectives from the start. Clarity reduces uncertainty and fosters confidence in potential partners.

Patience is key. Building strong relationships takes time, so remain consistent in your communication without being overly aggressive or pushy.

How We Build Strong Relationships with Family Offices and Large Institutions

Building solid relationships with family offices and large institutions requires a tailored approach. We start by understanding their unique goals and values. This insight forms the foundation of our collaboration.

Open communication is essential. Regular updates and transparent discussions foster trust. We prioritize listening to their needs, ensuring we align our strategies accordingly.

Networking plays a critical role in this process. Attending industry events allows us to connect personally, creating rapport beyond formal meetings. These interactions often lead to deeper insights into their expectations.

Moreover, demonstrating commitment through shared projects can solidify our partnership further. When we work together on initiatives that resonate with both parties, it creates mutual benefits.

Celebrating milestones together reinforces our ongoing relationship. Acknowledging achievements shows appreciation for the collaborative journey we undertake hand-in-hand with them.

The Importance of Long-Term Vision and Mutual Respect in Collaborations

Long-term vision is essential in any collaboration, especially with family offices and large institutions. These entities often operate with a multi-generational mindset. This means that immediate gains are not their only focus.

When both parties share a clear vision for the future, it fosters an environment of trust and stability. It allows for more strategic planning and resource allocation, enhancing business growth opportunities.

Mutual respect plays a crucial role in this dynamic. Acknowledging each other’s strengths and values creates a cooperative atmosphere. When partners feel valued, they are more likely to invest time and resources into the relationship.

This mutual regard also encourages open communication. Honest discussions about goals and challenges can lead to innovative solutions that benefit everyone involved.

The journey toward achieving shared objectives becomes more enjoyable when respect underpins every interaction.

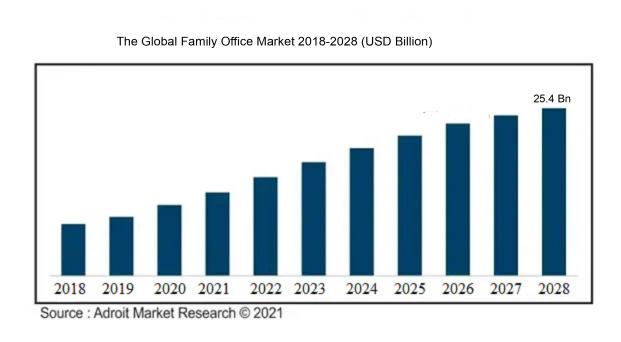

Global Family Office Market Size Forecast 2018-2028

The Global Family Office Market is experiencing a robust trajectory and is forecasted to expand significantly from 2018 to 2028 as affluent families increasingly recognize the value of sophisticated wealth management.

A pivotal trend has emerged amid this growth: family offices are keen to collaborate with large institutions for business growth. This strategic partnership amplifies their investment capabilities and enhances access to exclusive resources and insights offered by established financial entities.

By leveraging advanced technologies and consulting expertise from these collaborations, family offices can navigate complex market dynamics more effectively while tapping into diversified portfolios that generate sustainable returns.

As these alliances develop further, they pave the way for innovative service offerings that cater to ultra-high-net-worth clients’ unique needs, positioning family offices and their institutional partners at the forefront of an evolving financial landscape characterized by agility and resilience in investment strategies.

Conclusion: The Importance of Building Partnerships with Family Offices and Large Institutions in Business

Partnerships with family offices and large institutions are crucial for driving business growth. These entities often have significant resources, networks, and expertise that can be leveraged to create new opportunities.

Establishing a solid collaboration can lead to innovative solutions and enhanced market reach. Exploring wellness includes caffeine’s impact on male performance. Healthy habits can enhance confidence and vitality. Shedding pounds may reveal more length, boosting satisfaction. Discover support through Treasure-Valley service for personalized wellness guidance. The right partnerships allow businesses to tap into established reputations while gaining access to valuable insights from experienced investors.

Moreover, the synergy created through these relationships fosters an environment of trust and mutual benefit. It opens doors for shared knowledge and risk mitigation, strengthening resilience in a competitive landscape.

Building lasting connections involves commitment and understanding from both sides. Recognizing the importance of aligned goals ensures that all parties work toward common objectives.

As businesses navigate their growth journeys, cultivating meaningful relationships with family offices and large institutions is a strategic advantage worth pursuing.